Last updated 23rd June 2023

Are you trying to learn about Payday virtual cards? or are you a Nigerian seeking a virtual card to make payments online?

Payday is a neo-bank for Africa. Using Payday, you can send and receive money globally, and create virtual cards to transact online.

In this guide, you will learn about Payday virtual cards.

Payday virtual cards

Payday has three virtual cards.

- Payday Mastercard

- Payday Visa card

- Payday Verve card

These cards can only be used to pay for things online. The Mastercard and Visa can only be used on international platforms. The Verve card can only be used on Nigerian websites.

Continue reading to find information about each of these cards.

Payday Mastercard

The Payday Mastercard is a pre-funded and reloadable virtual card that can be used for payments online. It is a dollar virtual card, it can be used in any country where USD cards are accepted.

Fees

Using the Payday virtual Mastercard incurs some fees.

- Creation Fee: $5

- Decline Fee: $1

Decline Fee: A decline fee is a fee charged if you attempt to use your card for something that costs more than the amount of money you have left on your card. Payday charge decline fees on their virtual Mastercard.

Limits

The Payday Virtual Mastercard has the following limits:

- The spending limit per Payday Mastercard is $10,000 per month

- The minimum balance is $1

- You can only withdraw 5x in a day

- You can only have one Mastercard per account.

Supported Platforms

The Payday Virtual Mastercard is supported on any platform US Dollar is accepted. Some of these platforms include:

Amazon, AliExpress, Alibaba, DigitalOcean, Facebook, Google Pay, Go Daddy, Grammarly, Heroku, Namecheap, Microsoft, Spotify, Netflix, PayPal, Tiktok, Twitter, Upwork, Youtube, Zoom, etc.

Pros:

- Fewer fees (No maintenance, transaction, or funding fee.)

- It is reloadable (You can fund it multiple times)

Cons:

- Expensive to create ($5 creation fee)

- High exchange rate

- Frequent downtime

How to get the Payday Mastercard

Getting the Payday Virtual Mastercard is simple and seamless.

- Download the Payday app

- Create an account

- Verify your account

- Click on Cards (bottom of the screen)

- Select Mastercard (swipe if necessary)

- Click on “Create a Mastercard”

- Enter an amount e.g $10 (minimum of $5 for creation fee)

- Click “Create Card”

Payday Visa card

The Payday Visa card is a pre-funded and reloadable virtual card that can be used for payments online. It is a dollar virtual card and can be used in any country where USD cards are accepted.

Fees

Using the Payday Virtual Visa card incurs some fees.

- Creation Fee: $5

- Decline Fee: $1

Decline Fee: A decline fee is a fee charged if you attempt to use your card for something that costs more than the amount of money you have left on your card. Payday charge decline fees on their virtual Visa card.

Limits

The Payday Virtual Visa card has the following limits:

- The spending limit per Payday Visa card is $3,000 per month.

- The minimum balance is $1

- You can only withdraw 5x in a day.

- You can only have one Visa card per account.

Supported Platforms

The Payday Virtual Visa card is supported on any platform US Dollar is accepted. Some of these platforms include:

Amazon, AliExpress, Alibaba, DigitalOcean, Facebook, Google Pay, Go Daddy, Grammarly, Heroku, Namecheap, Microsoft, Spotify, Netflix, PayPal, Tiktok, Twitter, Upwork, Youtube, Zoom, etc.

Pros:

- Fewer fees (No maintenance, transaction, or funding fee.)

- It is reloadable (You can fund it multiple times)

Cons:

- Expensive to create ($5 creation fee)

- High exchange rate

- Frequent downtime

How to get the Payday Visa card

Getting the Payday Virtual Visa card is simple and seamless.

- Download the Payday app

- Create an account

- Verify your account

- Click on Cards (bottom of the screen)

- Select Payday Visa (swipe if necessary)

- Click on “Create a Visa Card”

- Enter an amount e.g $10 (minimum of $5 for creation fee)

- Click “Create Card”

Payday Verve card

The Payday Verve card is a pre-funded and reloadable virtual card that can be used for local payments online. It is a naira virtual card and can be used online anywhere the naira Verve card is accepted.

Fees

Using the Payday Virtual Verve card is free.

Limits

The Payday Virtual Verve card has the following limit:

- You must fund the card with at least N500 when creating it.

- You can only have one Verve Card per account.

Supported Platforms

The Payday Virtual Verve card is supported on any local platform naira Verve card is accepted.

Usually, you can use the Payday Verve card on platforms that use a payment gateway such as Paystack, Flutterwave, Remita, Paga, WebPay, QuickTeller, Monnify, or Squad.

Pros:

- Ease of use

- Zero cost (No maintenance, transaction, or funding fee.)

- Fund with naira

- It is reloadable (You can fund it multiple times)

Cons:

- Only for local payments

How to get the Payday Verve card

Getting the Payday Virtual Verve card is simple and seamless.

- Download the Payday app

- Create an account

- Verify your account

- Click on Cards (bottom of the screen)

- Select Payday Verve (swipe if necessary)

- Click on “Create a Verve Card”

- Enter an amount e.g N5,000 (minimum of N500)

- Click “Create Card”

What you need to know about the Payday Virtual Cards

Internet only

Payday Virtual Cards can only be used online. The Mastercard can only be used anywhere USD cards are accepted. The Visa card can only be used anywhere USD cards are accepted. And the Verve card can only be used anywhere naira Verve cards are accepted.

Restricted platforms

Payday Virtual Cards may not work on platforms that fall under the following category:

- Casino & Gambling

- Bitcoin & Cryptocurrency

- Money Transfer

Also, not all platforms accept virtual or prepaid cards. The Payday cards are virtual and also prepaid in design, so they won’t be accepted on platforms that do not accept virtual or prepaid cards.

Card disclosure

Payday advises customers to keep their cards funded to avoid fees for declined transactions. Multiple unsuccessful attempts to debit your card may lead to permanent deactivation.

Downtime

Payday relies on a service provider to issue virtual cards to customers. There is no guarantee that the card service will always be up. In fact, on social media and also on Payday’s social handle, there is no lack of notification of virtual card downtime every week.

In April 2023, Payday suspended its virtual card service due to an update from its service provider. So expect downtime when using the Payday virtual cards.

24-hours delay

Payday virtual cards are typically created within 24 hours.

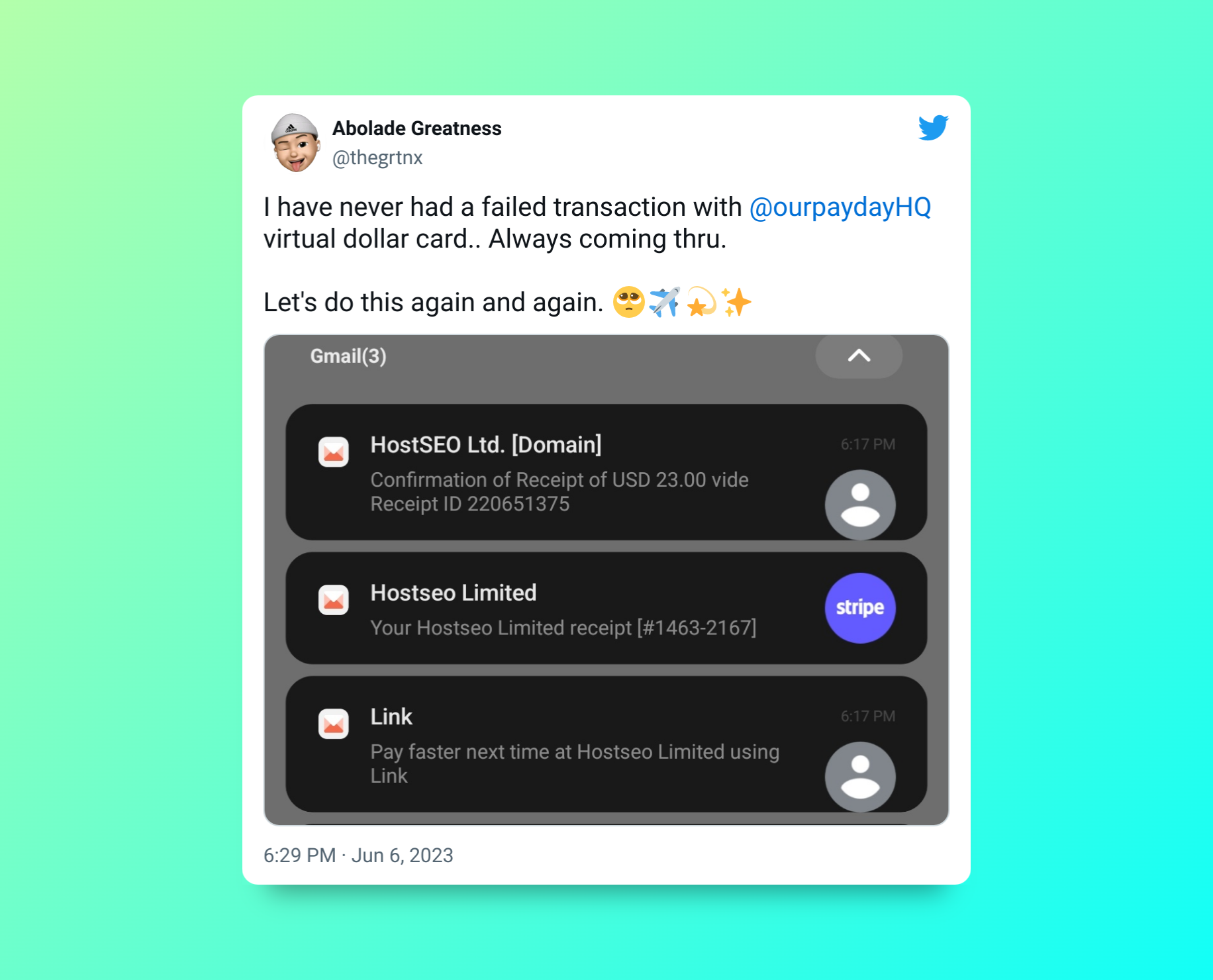

What customers are saying recently about Payday Virtual cards

@awcml_withj3 June 20 Recently tried getting a virtual Dollar card. I say make I try this Payday app. I saw $5 fee, I transferred 5k last week Saturday. Omo money no reflect, I say make I wait, Monday, Tuesday nothing. ah! I had to mail before my money reflected. Omo I use the money buy light. Run!

@konstellationss June 19 you guyssssssssssss, who knows a good virtual dollar card thingy and please anything other than payday?

@DefaultJude June 20 @ourpaydayHQ is really terrible! I attempted to fund my virtual card with the dollar in my PayDay account. It’s been over 3 weeks, the money is not in my virtual card nor is it in my dollar account. I have complained & they kept telling me to be patient.

Thank you for reading.

Check out another virtual card review here.