Africa’s economy is like a child in trouble. And guess what? Pan African Payment and Settlement Solution (PAPSS) is the superhero to the rescue.

That’s right. Before PAPSS, Africa lost approximately USD 5 billion yearly in transaction costs. Local businesses don’t have to spend so much anymore since the Pan-African solution is highly cost-effective.

Follow us as we dive into the details of this home-grown solution, how it works, and why it is so important for Africa.

What is the Pan African Payment and Settlement System (PAPSS)?

PAPSS is an infrastructure for seamless exchange of African currencies. Otherwise called the Pan African Payment and Settlement System, this system facilitates direct intra-continental payments. The aim of PAPSS is to boost the African economy.

About PAPSS

PAPSS went live on January 13, 2022. It was launched by Ghana’s serving president, H. E. Nana Addo Dankwa Akufo-Addo - represented by his vice.

The Pan African Payment and Settlement Solution is the brainchild of the African Export-Import Bank (Afreximbank). This institution is primarily responsible for empowering African trade. As a result, it collaborates with several African central banks.

PAPSS is currently operational in six West-African countries. These are called the West African States Monetary Zone (WAMZ). The participating countries are Nigeria, Gambia, Sierra Leone, Liberia, Ghana, and Guinea.

How PAPSS Works

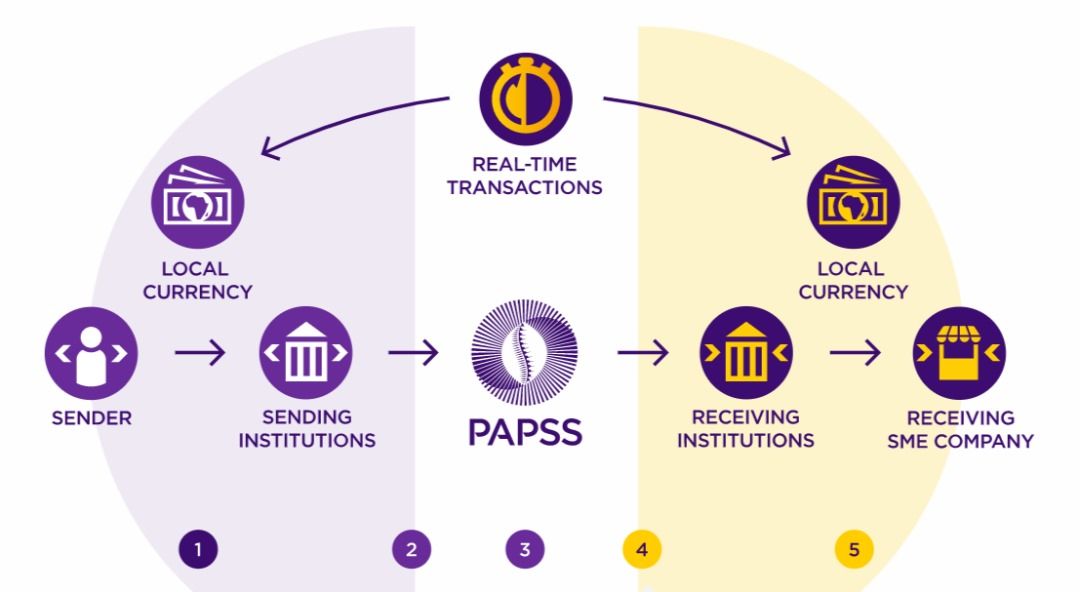

For a clear understanding of PAPSS, read on RTGS. Real-Time Gross Settlement is a common payment framework. Many African central banks utilise this internally.

What the PAPSS does, then, is very simple. It serves to connect the RTGS of individual central banks. With that in place, the system settles transactions between local currency pairs.

All PAPSS settlements are made before a new day begins. This ensures the system starts at net zero on the following day. The involved central banks will then take over after the initial settlement.

The Need for a PAPSS

PAPSS is important for Africans. For one thing, it resolves the dependence on foreign markets.

African locals have a high preference for foreign products. They place so much value on goods manufactured overseas. In many cases, they see such products as genuine or superior to indigenous ones.

It is unfortunate to say that government officials also portray this view.

You would find that most African presidents ditch local services. They use foreign alternatives for just about everything.

They fly out for medical checkups and recreation. They buy their escort vehicles from brands like Mercedes. They even invest their money in foreign banks and assets. The list goes on and on.

This situation alone diverts funds out of the African economy. But it is not the only shameful issue on ground. So what could be worse? Well, here it is.

Foreign currency is dominant within intra-African trades. In clear terms, we’re saying that African countries do not directly exchange their currencies when transacting. They, instead, make use of a central/conversion currency. This is often the US Dollar, the British Pound, or some other currency such as Yen.

So a Southern-African country can transact with a Northern-African country. However, payment is not straightforward. The sender first converts their local currency to the chosen conversion currency.

From here, the receiver converts from the central currency to their own local currency.

This all happens within Africa. And in this case, the government behind the conversion currency earns a token. They profit through conversion or transaction fees.

With this, we see the African market suffer in two ways. First, Africans themselves are buying from foreign markets—secondly, intra-African trade profits countries such as the US (through conversion fees). The continent’s economy is consistently neglected and starved.

Solving these problems required a home-grown product. The African Export-Import Bank (Afreximbank) stood up to the challenge. The bank took the responsibility for developing PAPSS.

This platform provides a new settlement for intra-African transactions. Precisely, it eliminates the need for a foreign conversion currency.

PAPSS removes the third party in intra-African trade payments. It means that any fees paid are made to local institutions. Moreover, the fees for using this platform are relatively low compared to what they were.

How to Transfer Using the Pan African Payment and Settlement System

There are six steps for transferring money with PAPSS. Here’s how to go about it:

1. Check your Bank’s Availability on PAPSS:

Not all banks are available on the PAPSS network. That means not all banks can help customers perform PAPSS-based transactions. To start a transfer, you must confirm your bank’s availability.

You can scan the PAPSS QR-code to see bank lists. Alternatively, you may go directly to the network’s website.

2. Identify the Countries Where You Can Transfer Money to:

PAPSS was made to support intra-African trade. However, not all countries within the continent have adopted the technology. This means users need to confirm the countries they are sending money to.

If your receiver’s country is eligible, you can move on to the next step. If not, you have to utilize the traditional means of transfer.

3. Access a PAPSS Service Channel:

Confirming your receiver’s country eligibility was the second step. What’s next will be to choose a service channel.

This refers to the means in which you would conduct the PAPSS transfer.

Three options exist for accessing the PAPSS network. It’s either your bank’s branch, mobile app, or online banking platform. You can choose based on preference and ease of access.

4. Initiate a Transfer:

The process of initiating a PAPSS transfer differs. If you’re making a transfer at your bank, you’d start by informing the bank staff. These individuals are well-versed in handling such requests.

Digital means such as bank apps or online banking platforms present a button instead.

5. Follow Instructions:

Operations like a PAPSS transfer may appear similar to regular transfers. However, it is unsafe to work based on such assumptions. What is advisable is following instructions strictly.

Each PAPSS channel has well-explained steps for users to follow. This works like a manual. It gives directions on how to access and use the PAPSS properly.

For instance, if you’re accessing the service through a bank app, such a platform will provide full details on how to make a transfer. The same is true for the online banking option.

Features of the Pan African Payment and Settlement System

The Pan African Payment and Settlement System sports some unique features:

- Payments are directly converted from one African currency to another. This maintains the value of local currencies. It also fosters the adoption of local financial instruments.

- The PAPSS is said to conduct payments in under 2 minutes max. During this time, the platform conducts multiple checks on transactions. Some of the confirmations include compliance, sanctions, etc.

- Transactions on PAPSS occur on a Multilateral Net Basis.

- The PAPSS remains online 24/7, ready for use.

Benefits of the Pan African Payment and Settlement System

- Improved infrastructure within African banks: This involves the availability of systems and servers that support the PAPSS process.

- Upskilling among banking staff and financial authorities: The PAPSS functions differently from conventional intra-African payment methods. Technical staff will have to familiarize themselves with the new technology. Non-technical staff, such as managers, may also need to learn a thing or two.

- Increased level of collaboration among the participating countries: Take settlement agreements for example. Participating countries must have mutual understanding and give their consent and support. That is the only way a settlement can be implemented.

- Ease of trade payments: Previously, the US dollar stood as a central payment currency. Sender’s funds were converted to this denomination. Afterwards, the funds were then converted to the receiver’s currency. This is no longer the case. The introduction of PAPSS allows for the sender’s funds to be switched to the receiver’s denomination. The US dollar and associated infrastructure is no longer needed.

- Reduced Cost of intra-African transactions: Costs are now significantly reduced for intra-African traders. Both governments and individual entities trading amongst themselves stand to benefit here. This is because 3rd parties are eliminated from the transfer/settlement process.

List of Nigerian Banks on the PAPSS Network

As of July 2024, 19 Nigerian banks supported PAPSS transactions. These institutions are all registered to the settlement network. Their action implies a belief in the purpose and usefulness of the system.

By supporting PAPSS, Nigerian banks are repositioning themselves. They intend to serve as platforms facilitating the proposed PAPSS functions. Moreover, their participation is critical considering the country’s transaction volume and trading activities.

- First Bank of Nigeria

- United Bank of Africa

- Access Bank

- Stanbic IBTC

- Sterling Bank

- Wema Bank

- Keystone Bank

- Lotus Bank

- Providus Bank

- Union Bank

- Jaiz Bank

- Zenith Bank

- Fidelity Bank

- Optimus Bank

- Coronation Merchant Bank

- Parallex Bank

- Taj Bank

- FSDH Merchant Bank

In addition to the above, the following institutions are making preparations to support PAPSS.

- EcoBank

- FBNQuest Merchant Bank

- First City Monument Bank

Conclusion

The Pan African Payment Service Solution (PAPSS) is here to stay. This technology has successfully redirected funds back into Africa. It is also promoting transactions among African countries.