You may have heard, at the bank or when registering on a digital platform, that you need to complete your KYC to access certain products or services. You’ll be asked to provide information about yourself and maybe even provide evidence that such information is true.

This process is helpful, both to you as a user and to the institution you are interacting with. Below, we break down KYC to reveal concepts and definitions.

Know-Your-Customer (KYC) Meaning

Know-Your-Customer, simply referred to as KYC, is a security procedure implemented by businesses towards their new and existing customers/clients.

It involves identifying the entities they partner with, the individuals that use their services, and the activities of these parties during the time of their engagement together.

The goal of the KYC procedure is to understand customers/clients and track their activities, ensuring that they remain compliant with lawful practices.

One of the profound benefits here is brand protection. Businesses that have their platforms misused or abused by criminals often end up attracting a negative outlook for themselves. This is true, even when such activities or the perpetrators did not have any internal backing.

Besides, other users of a business’s product or service may be scared off from engaging with the business and investors will find the brand unattractive.

Why KYC In The First Place?

You might want to ask what businesses do if they realise that a customer is abusing their system or service. After all, we’ve mentioned that brands become unattractive from such unpleasant events and KYC is designed to prevent this.

So what is it that businesses do when their KYC measures expose a bad actor client or customer?

The answer is that they respond in one of two ways. They either completely exclude such a party from interacting with their brand or they allow partial or full access with close monitoring. This keeps the platform secure from abuse and also protects other users from falling victim.

KYC Procedure

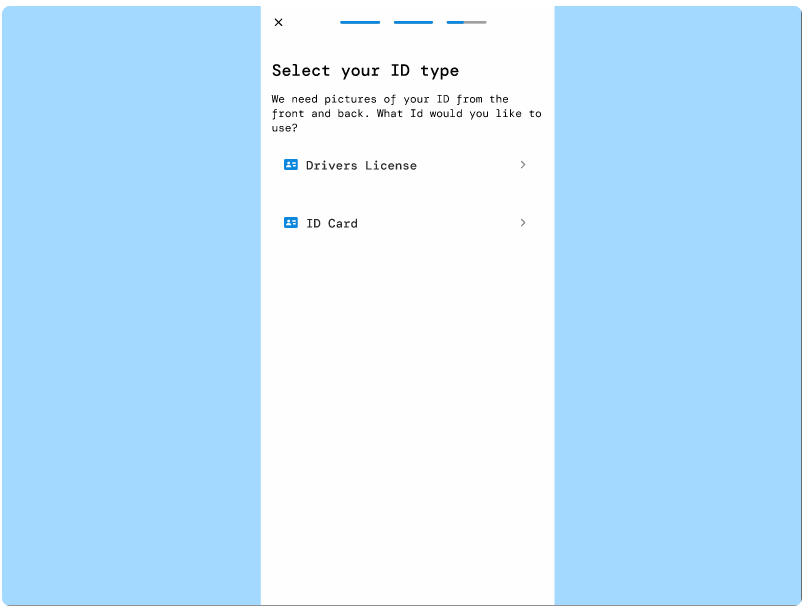

The entire KYC procedure is hinged on the first step which is customer identification. This involves a request for personally identifying information such as name, address, and government-issued ID like a driving license.

Properly identifying your customers may be important. But it is not the only step in the KYC procedure. You see, the entire procedure consists of three steps all of which are quite vital to the success of the initiative.

Customer Identification

Customer Identification, as we have highlighted, is the number one step in the KYC procedure. Without this, the Know-Your-Customer process cannot be said to have begun.

Just as you meet people for the first time and ask for their names or other personal information, businesses also need to know the names and information of people they are interacting with.

Customer Due Diligence

Collecting identity information creates a platform for background checks, where a user’s criminal record is reviewed. In addition, background checks help businesses to confirm the validity of the information provided during the identification phase.

Information obtained from reviewing a user’s background is analysed to determine whether the potential customer presents any kind of risk.

This act (involving background checks and decisions based on it) is summarised as Customer Due Diligence (CDD). It is every business’s responsibility to perform this due diligence on their customers. Doing so provides an understanding of the best way to serve each user, the level of monitoring necessary, and the most suitable channels to implement all of these.

Ongoing Monitoring

Undertaking Customer Due Diligence (CDD) allows a business to determine whether to provide service access to an individual or not.

Now, let’s say a particular user is cleared by CDD and given access to a business’s service. Despite having their risk analysed and being cleared as safe, the business has to continuously monitor the user’s activities.

The monitoring process runs throughout the time of engagement between the customer and the business.

KYC Checks

By checks, we are referring to information or documents which businesses request from users in fulfilment of the KYC process.

User’s Name

One of the very first KYC requirements is the submission of the individual’s full name. Unlike informal relationships that involve a first-name or nickname basis, business relationships work on a full-name basis.

User’s Address

The business you are registering with will ask to know your house address. In some cases, this field might be separated as “residential address” and “permanent home address”.

User’s Mobile Number

The phone number requirement typically applies to local businesses, such as those operating within Nigeria. Nevertheless, foreign businesses may also require your phone number for contact and verification purposes.

User’s Email

Many Nigerian businesses require email verification during KYC.

Copy of User’s Passport/Voters’ Card/Driving License

A voter’s card and driving license are two essential IDs owned by Nigerians. Businesses running their KYC will likely ask you to present one or both of these documents.

You will have to upload the required ID, either as a file (after scanning it) or as an image (after taking a picture of it).

User’s NIN

NIN stands for National Identification Number. The Nigerian government developed this system as a unified way of identification.

Submitting your NIN lets businesses verify your identity as a Nigerian, and perhaps see details of your age, address, and more.

Copy of User’s Utility Bill Receipt

Receipts from your most recent utility bill payment may also be requested for a KYC process. Such documents are particularly important since they carry information such as name, house address, telephone number and more.

Bill receipts serve to confirm the validity of your previous document submission.

Benefits of KYC

Fraud Detection:

KYC involves continuous monitoring of customers and clients, enabling businesses to detect fraudulent activities early on. This way, misuse or abuse of a platform can be identified before it becomes threatening to the organisation or the general public.

Fraud Prevention

In a number of cases, KYC allows both for detection of fraud and the prevention of it. Early prevention may be initiated when fraud is detected in the early stages. For instance, the fraudster’s account with the bank can be traced and subsequently frozen, with previous transactions reversed (if possible).

However, even when a fraudulent operation has been successfully implemented, businesses can use KYC information to track perpetrators, recover funds, etc.

Service Efficiency

Understanding a customer through KYC is necessary for delivering an effective service. For instance, utility bill receipts show how consistent an individual is with their payments. Businesses can use this to determine what level of commitment to expect from a potential user.

Alternatively, information about a user’s salary range could give businesses an idea of what product they can afford (based on price). This reduces or eliminates fruitless marketing efforts.

Compliance

Implementing KYC is more or less an obligation for many types of businesses, especially those involved in finance or banking. Also, when a business performs KYC, it enforces compliance from users of their platform or service.

It means that both businesses and customers exercise compliance when a business implents KYC.

Conclusion

There are a lot of benefits of KYC, as we see in the preceding section.

However, businesses and institutions must ensure that they properly control and secure the data extracted from their users. This brings up the topic of data usage and privacy.