With over $2 billion in annual trade with China, it’s crucial to understand how currency fluctuations can impact profitability. This guide arms Nigerian traders with insights on how to secure the best naira to yuan exchange rates in 2024.

Importing products from China using 1688.com or Aliexpress has been saving businesses in Nigeria as it can be extremely lucrative. Nigerians tend to take advantage of the lower prices and high quality of goods. Currently, the mid-market exchange rate hovers around 1 Chinese Yuan to 127.73581862 Nigerian Naira. This over 30% swing in just a few years directly impacts the bottom line for local importers. As the Naira weakens compared to the Yuan, securing inventory from Shanghai to Lagos becomes more costly.

For context, 100,000 Yuan for a shipment of electronics in 2020 would have required about 43 million Naira when converted. Today, that same 100,000 Yuan Chinese invoice will run a Nigerian importer over 51 million Naira - an extra 8 million in currency exchange difference.

So, as a typical business owner looking to make profits, it is essential to be familiar with the current rate of one yuan to one naira (1 CNY = 126 NGN).

The big question remains: How do I get the best exchange rate?

Chinese Yuan To Naira Black Market Exchange Rate

First, you need to understand that there’s an official exchange rate and a black market rate.

The black market also known as the parallel market, is an unofficial and unregulated market where rates are determined by the scarcity and volatility of the foreign currency.

It is usually higher than the official rate, which is the price set by the Central Bank of Nigeria (CBN) for the same currencies. The official CBN rate is based on the supply and demand of the foreign exchange market, as well as the monetary policy of the CBN

Many Nigerians use the black market rate to buy or sell foreign currency, especially when importing goods from China. According to Monierate, the current CNY/NGN black market rate is:

- Buying: CNY 1 = NGN 200.62

- Selling: CNY 1 = NGN 195.62

Since the black market is unregulated, the second question you might be asking is: How can I get the best deals without getting scammed?

Here are some tips to help you get the best deal possible using the black market:

Compare the rates

Before exchanging your naira, it’s important to research and compare black market rates with the official ones, ensuring you get the best deal. You can use tools like Ngnrates and Monierate.

Reliable black market dealers, offering competitive rates and quality service, can be found both online and in person, but typically in major cities or commercial areas.

Note that: Renminbi (RMB) and yuan are often used interchangeably to refer to China’s currency. Yuan refers to the currency’s primary unit. The yuan serves the same role as the dollar or the pound.

Negotiate the rate

Yes, it is possible to negotiate rates on the black market. Once you find a dealer who can offer you a reasonable rate, it’s okay to bargain for a lower fee, a better rate, or a faster service. You can also ask for a written receipt or a confirmation message for the transaction.

Exchange the money

After you agree on a rate and the amount, you can now exchange the money with your dealer. You can do this by handing over your Yuan in cash or by transferring it to their bank account or mobile wallet. You can then receive your Naira in cash or your bank account or mobile wallet. Remember always to confirm the transaction before and after it is made.

Related Post: How to Send and Recieve Euros from Nigeria

Track the exchange rate

After you exchange your money, you should track the currency exchange trends and see how it change over time. This would help you find the right wave for your next exchange date.

You can use online tools, such as TradingView, or XE, for a comprehensive view of the naira’s performance against the yuan over time, including expert analysis. You can also use tools like Xe Rate Alerts, to get personalized notifications for desired rate levels and Aboki Forex to get daily updates and alerts on black market rates.

Savvy importers also watch out for economic or political news updates such as inflation spikes or central bank rate changes, which can significantly impact currency values.

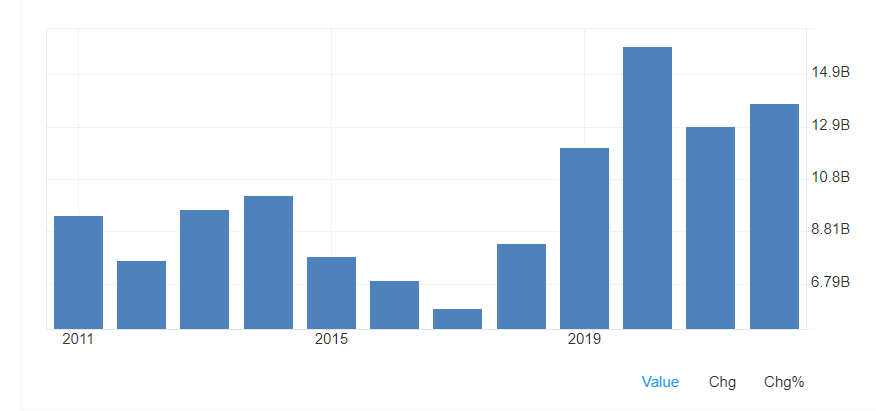

Nigeria Imports from China was US$13.77 Billion during 2022, according to the United Nations COMTRADE database on international trade.. | Source

The black market is not the only way to send or receive CNY in Nigeria. There are other convenient and cost-effective methods. Keep reading as we explore some of them below.

Other Methods of Buying the Chinese Yuan in Nigeria

Besides the local Nigerian banks mentioned earlier, you can use exchange bureaus or digital payment solutions. Each of these methods has its pros and cons. Here’s how you can compare and contrast them before choosing the best one for your needs:

- Fees: How much do they charge for their service? Are there any hidden fees, such as withdrawal, conversion, or delivery fees?

- Rates: How good are their exchange rates? Are they based on the market rates, or do they have markups, spreads, or fluctuations?

- Speed: How fast can they process your transaction? Can you send or receive money in minutes, hours, or days?

- Convenience: How easy and accessible is their service? Can you use them anytime, anywhere, and on any device?

- Reliability: How secure and trustworthy is their service? Do they have any security issues, technical glitches, or customer complaints?

- Support: How responsive and helpful is their support team? Can you contact them anytime if you have any questions or issues?

N.b: Another way to avoid risks associated with fluctuations in exchange rates is to quote prices and require payment in U.S. dollars.

Using the app with the best exchange rate ensures your recipient will receive nearly all the money you send them. Depending on how large the transfer is, some services may save you more money. You can compare costs across the different companies to find the best option.

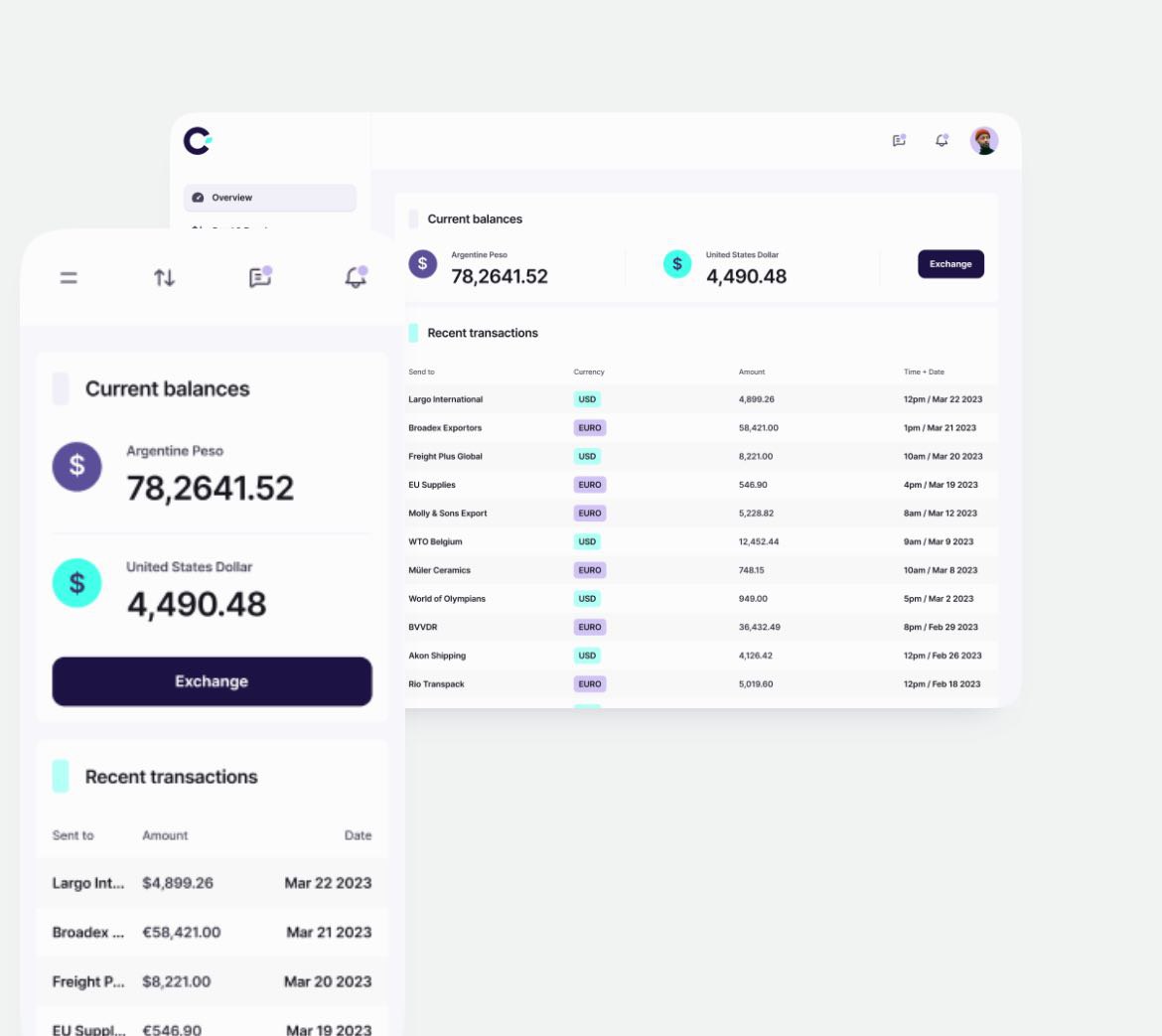

And since we’ve long been committed to streamlining your digital transaction processes, platforms like Cedar Money now offer competitive and more secure alternatives for international exchanges.

You can use Cedar Money to send and receive money in over 40 currencies, including the Chinese yuan.

How does it stand out from the rest?

- Low fees: Cedar Money charges a flat fee of 0.5% per transaction, which is much lower than the fees charged by banks or exchange bureaus. There are no hidden fees, no commission fees, and no transfer fees.

- Best exchange rates: Cedar Money offers the best exchange rates, based on real-time market rates. There are no markups, no spreads, and no fluctuations.

- Fast and reliable service: Cedar Money can process your transaction in minutes, not days or weeks. You can send or receive money anytime, anywhere, and on any device. You can also track your transactions and get instant notifications on your dashboard. You can also contact their support team anytime with questions or issues.

How to Use Cedar Money to Buy Goods from China with the Best Naira Exchange Rate

Each digital payment service provides clear instructions on how to send money internationally. But they generally follow the same process.

- Visit the Official Website: Go to Cedar’s official website to begin the process.

- Click “Get Started”: Look for the “Get Started” button on the website and click on it to initiate the process.

- Submit Company Information: Fill out the required fields with your company information. This may include details such as the company name, location, and monthly international payment volume.

- Introductory Call: Within a short timeframe, typically within 60 minutes, expect an introductory call from Cedar. During this call, Cedar representatives will guide you through the payment processes and address any queries you may have.

- Discuss Payment Processes: During the call, Cedar will explain the payment procedures tailored to your business needs.

- Payment Processing: Once the introductory call is complete, Cedar will assist you in processing your payments to your suppliers in China. This streamlined process ensures a quick and efficient experience for businesses like yours.

N.b: The minimum payment volume you can process with Cedar is 10,000 US Dollars.

Concluding

Getting the best exchange rates whilst running an importation business in Nigeria can get tricky, but thankfully, there are now cost-effective and profitable options to choose from. Several factors must be considered when determining how to send money internationally with the fewest and lowest fees. Compare your options and find a less expensive rate for your needs before buying goods from China.

Happy importing!