Africa’s digital economy is increasing rapidly, and payment gateways are at the centre of the transformation, with mobile money transactions projected to reach $500 billion by 2030.

Gateways are enabling seamless transactions across borders, currencies, and platforms.

From PayPal’s international reach to M-Pesa’s local dominance, these platforms are redefining access to finance for millions of unbanked Africans.

Why does this matter? Payment gateways are bridging the financial divide, powering e-commerce, driving financial inclusion, and attracting global investor interest.

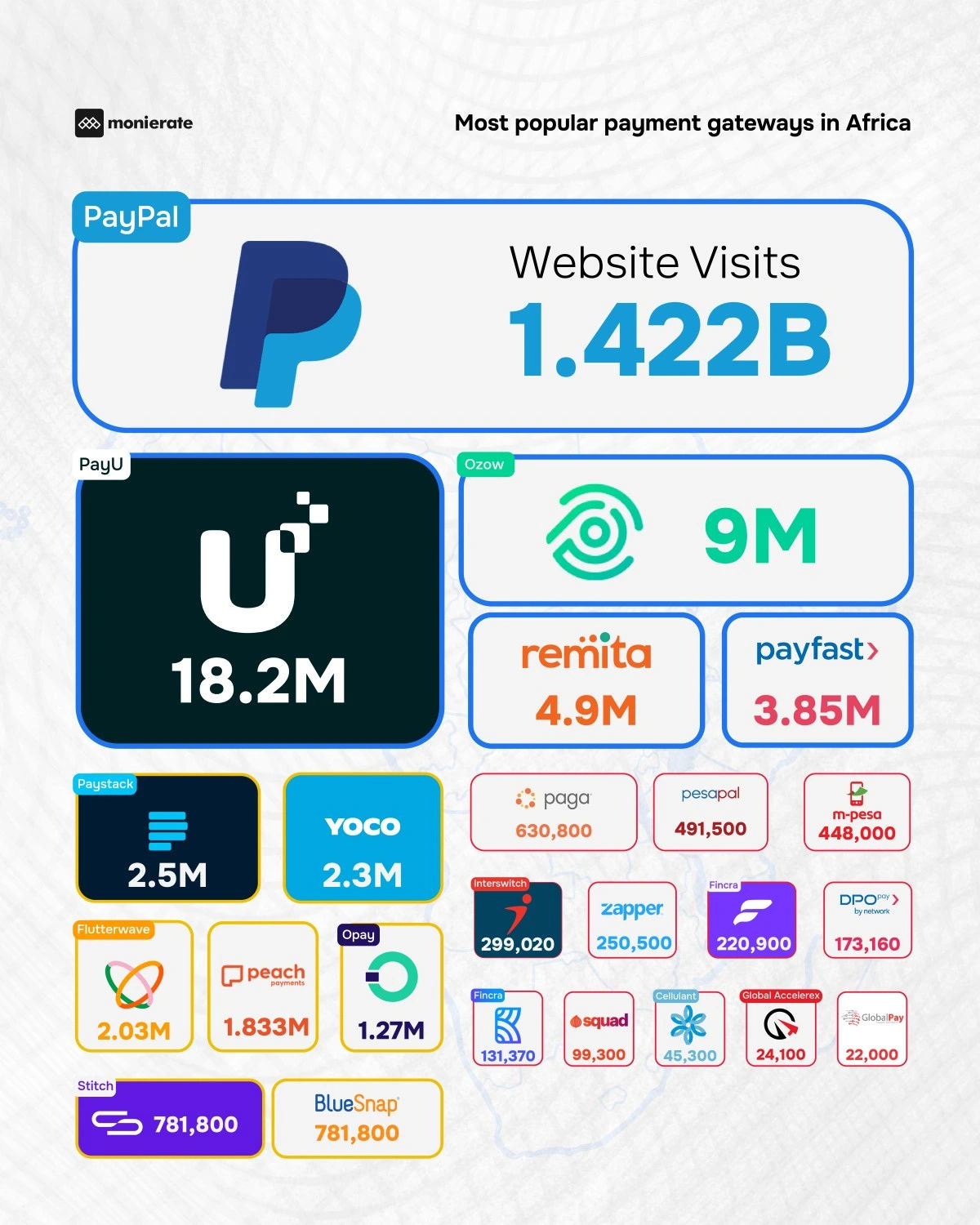

This report ranks Africa’s leading payment gateways by website traffic in Q2 2025, offering a snapshot of who’s winning the digital payment race and why.

This report breaks down their key transaction methods (mobile money, cards, QR codes), regional dominance (Nigeria, South Africa) and emerging trends like AI integration and crypto support.

Whether you’re an investor watching Nigeria’s fintech evolution or a startup navigating South Africa’s gateway ecosystem, this report delivers actionable insights to stay ahead in Africa’s dynamic digital payments landscape.

Key Takeaways

- PayPal Leads with 1.42B Website Visits: Its global reach and diverse payment options (cards, digital wallets, buy now pay later) dwarf competitors, but local players are gaining ground discreetly in Africa.

- Nigeria and South Africa Dominate: 17 and 15 companies, respectively, have a strong presence in Nigeria and South Africa, reflecting robust Fintech ecosystems driven by mobile money and QR codes.

Mobile Money Rules East and West Africa: M-Pesa (Kenya) and Paga (Nigeria) thrive with mobile-first solutions, catering to unbanked populations in high-growth markets.

QR Codes Surge in South Africa: Yoco, Zapper, and SnapScan Capitalise on Contactless Payments, Signalling a Shift Toward Tech-Savvy Consumer Behaviour.

Emerging Markets Offer Opportunity: Rwanda and Tanzania, with fewer players (e.g., Pesapal), present untapped potential for scalable Fintech solutions.

Get Access

The raw research data is available for download here.

Ranked: Most Powerful Payment Gateways in Africa by Website Traffic (Q2 2025)

Africa’s payment landscape is fiercely competitive, with website traffic reflecting market reach and consumer trust.

Traffic data signals digital adoption, but local players like Paystack and M-Pesa shine by addressing Africa’s unique needs i.e low banking penetration and mobile-first consumers.

| Platform | Visits | Payment Methods | Presence | Strength |

|---|---|---|---|---|

| PayPal | 1,422,000,000 | Card payments, bank transfers, PayPal balance, digital wallets, BNPL | Nigeria, South Africa, Kenya, Ghana, Algeria, Angola | Massive global reach and multi-currency support, though less tailored to Africa’s unbanked |

| PayU | 18,200,000 | Card payments, bank transfers, USSD, mobile payments | Nigeria, South Africa, Kenya, Ghana | Strong regional presence with flexible payment methods for e-commerce |

| Ozow | 9,000,000 | Bank-to-bank EFT, cardless payments | South Africa, Namibia | Leading South Africa’s instant payment trend with seamless EFT solutions |

| Remita | 4,900,000 | Card payments, bank transfers, and mobile money | Nigeria | Deep integration with Nigerian banks, driving government and enterprise payments |

| Payfast | 3,850,000 | Card payments, EFT, mobile wallets, digital wallets, QR codes | South Africa | Versatile options for South African SMEs, with growing QR code adoption |

| Paystack | 2,500,000 | Card payments, bank transfers, USSD, mobile money | Nigeria, Kenya, Ghana, South Africa, Rwanda | Scalable platform for startups, with strong multi-country presence |

| Yoco | 2,300,000 | Card payments, contactless payments, EFT, QR codes | South Africa, Mozambique | Empowering small businesses with affordable POS and contactless solutions |

| Flutterwave | 2,030,000 | Card payments, bank transfers, USSD, mobile wallets, Barter | Nigeria, Kenya, Ghana, South Africa, Uganda | Pan-African platform with innovative cross-border payment solutions |

| Peachpayment | 1,833,000 | Card payments, EFT, digital payments, BNPL, vouchers | South Africa, Kenya, Mauritius | Flexible options for e-commerce, with buy now, pay later gaining traction |

| Opay | 1,270,000 | Card payments, bank transfers, mobile wallets | Nigeria, Egypt, Ghana | Rapid growth in Nigeria’s mobile money space, challenging incumbents |

The rankings reveal a two-tier market: global giants like PayPal dominate traffic, but local players like Paystack, Flutterwave, and M-Pesa excel in addressing Africa’s unbanked through mobile money and USSD.

South Africa’s surge in QR code adoption (Yoco, Payfast) reflects tech-savvy consumers, while Nigeria’s crowded market signals fierce competition.

These trends matter because they highlight where investors, startups and policymakers should focus on scaling mobile solutions, navigating regulations, and tapping emerging markets like Rwanda.

Researchers Take

As a researcher immersed in Africa’s digital transformation, certain findings and takeaways around this sector are somewhat surprising, e.g, the resilience of local payment companies challenging global giants like PayPal.

This report’s rankings show a healthy competition between the foreign market and local market, even though the foreign companies(PayPal) lead in terms of recognition and traffic, local companies like Flutterwave and Paystack thrive by solving Africa-specific pain points ~ unbanked populations and fragmented banking systems.

Nigeria’s dominance also reflects its vibrant startup scene, but regulatory hurdles like cross-border licensing is a threatening issue. South Africa’s QR code adoption, on the other hand, signals a tech-savvy future, while Rwanda’s sparse Fintech presence screams opportunity.

I feel Investors should back local mobile-first platforms, startups must also prioritise compliance, and policymakers need harmonised regulations to unlock a $150B market.

Having seen M-Pesa transform Kenyan markets firsthand, I’m bullish on Africa’s Fintech future.

This report analyses 30 African payment companies, with data collected in Q2 2025. Website traffic was sourced from SimilarWeb, reflecting digital reach.

Payment methods and country presence were compiled from company websites, public filings, and third-party reports (CB Insights, GSMA)

Limitations include potential underreporting of mobile app traffic and incomplete data for private firms like Opay.

Our multi-source approach ensures robust insights into Africa’s payment landscape.